3 Ways to Add Efficiency to the Classroom

As a teacher, one of the most important things to understand is that there is no "one size fits all" approach to what you're doing. We all learn in our unique ways. Because of that, you need to rise ...

-

The Role of Technology in Facilitating Collaborative Learning Environments, Explored by Sarwar Khawaja

-

How to Elevate Your Freelance Game and Land More Clients

-

Evaluating the Impact: How QA Will Assess the Power of New Generative AI-Based Testing Tools

-

Transforming Customer Interactions Using Artificial Intelligence

-

How Hybrid Cloud Strategies Can Revolutionize E-Commerce

-

Advancements in Management Algorithms for High-Traffic Networks

-

The Symbiotic Relationship Between Product Management and Digital Payment Innovations in Financial Services

By Lakshmi Sushma Daggubati -

Navigating the Tech Stack: Choosing the Right Tools for Your Startup's Web Development

By David Thompson -

Top 9 Laptops for Students: Lightweight, Affordable Computers You Can Bring To School

By Joy Liwanag -

Insights from an Automotive Rewards Program Product Owner

By Vijeta Aluru -

How Women are Breaking Through the Glass Ceiling of Product Management

By Soundarya Chandar -

Studying Smarter: iPad Productivity Hacks for Tech Students

By David Thompson -

Recognizing the Signs for AC Repair in Las Vegas: A Complete Guide

By David Thompson -

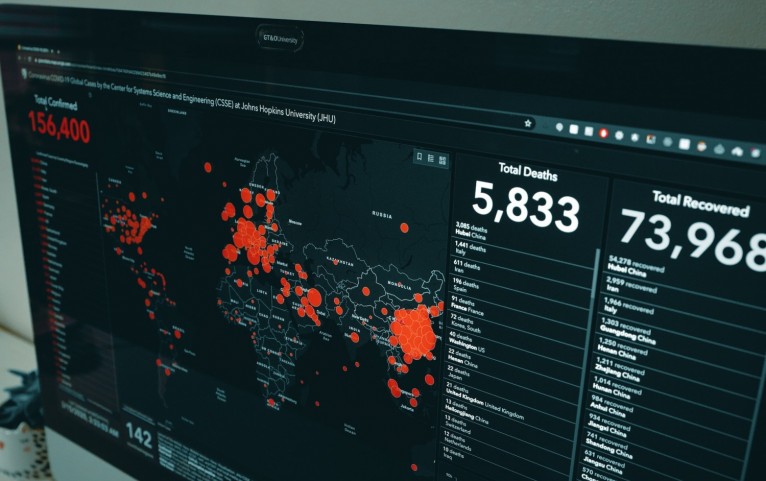

Unleashing the Power of Data Visualization: Transforming Social Impact Initiatives

By Arjun Karat -

Data Integrity as a Code (DiaC): Best Practices for Organizations

By Sasidhar Duggineni -

Dissecting the CMS Spectrum: Headless vs. Traditional Content Management Systems

By Ujjval Pandya -

Revolutionizing Design Optimization With Advanced CFD Simulation Software

By David Thompson -

Executive Consultant Kevin Modany Highlights 3 Game-Changing Management Consulting Advancements

By David Thompson