Netanyahu to Anti-Israel Protesters: 'You Have Officially Become Iran's Useful Idiots'

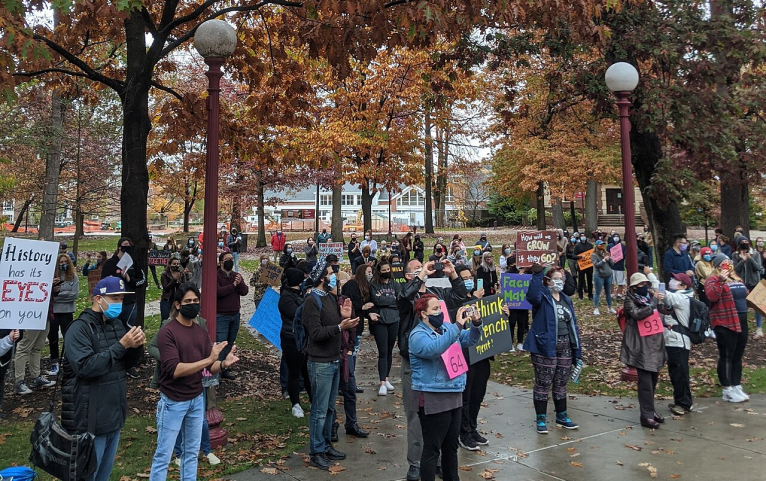

Israel Prime Minister Benjamin Netanyahu's address to a joint meeting of Congress on Wednesday afternoon included scathing remarks to people participating in anti-Israel protests. Read to learn more.

-

Monmouth University Lockdown Lifted After False Bomb Threat

-

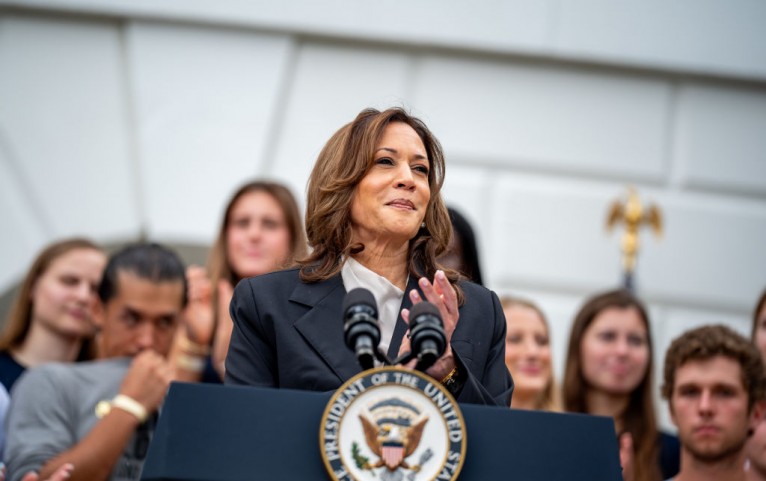

VP Kamala Harris Could Become First President to Graduate From A Historically Black College or University

-

YSU Lockdown Triggered by Shooting Suspect Sighting on Campus; Community Concerns Mount After Lockdown

-

Brandeis Center Sues Education Department for Dismissing Antisemitism Complaint Against University of Pennsylvania

-

NYU Settles Lawsuit With Students Over Antisemitism Claims; University Expands Judaic Studies and Strengthens Ties With Tel Aviv University

-

House Ways and Means Committee Advances Bills Targeting University Antisemitism; Democrats Warn of Potential Litigation and Consequences for Higher Education

-

US Higher Education Trends: State Funding Rises as Tuition Income Falls; What Can UK Learn From This?

By Joy Liwanag -

Trump's Republican Platform Agenda47 Proposes Radical Overhaul of Higher Education Policies

By Joy Liwanag -

Congress Introduces Campus Housing Affordability Act, Expanding Section 8 Voucher Access for College Students

By Joy Liwanag -

Northwestern College Shuts Down After 122 Years, Leaving Students and Higher Education Community in Limbo

By Joy Liwanag -

Antisemitism and Islamophobia: Brown University Settles With Department of Education's Office for Civil Rights on Title VI

By Joy Liwanag -

Americans' Confidence in Higher Education Continues to Decline Amid Rising Concerns Over Political Bias and Cost [Poll]

By Joy Liwanag -

Columbia University Deans Removed After Antisemitic Texts Spark Controversy Amid Campus Tensions

By Joy Liwanag -

Bloomberg Donates $1 Billion to Make Medical Education Free at Johns Hopkins, Redefining Access to Healthcare Professions

By Joy Liwanag -

Federal Judge Blocks Biden Administration's Title IX Regulations in Another 4 States, Citing Overreach and Vagueness

By Joy Liwanag -

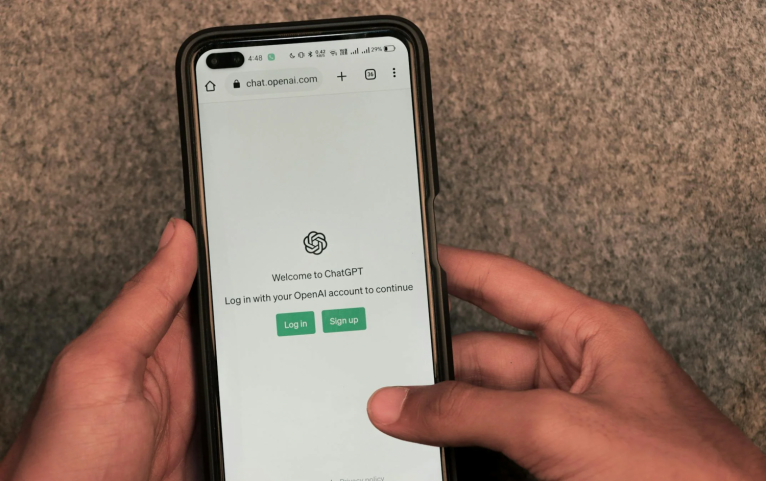

Lehigh University Expels Student Who Admitted to Forging Documents and Using ChatGPT To Write Essay for Scholarship; Concerns Over AI in Admissions Grow

By Joy Liwanag -

African Students Rack Up Debt Despite Full Bursaries from NSFAS

By Joy Liwanag -

ICE's Fake University Students Win Right to Sue US Government

By Joy Liwanag