Teachers Union Lawsuit Accuses Student Loan Company of Misleading Millions of Borrowers

The American Federal of Teachers filed a lawsuit against the Missouri Higher Education Loan Authority, or MOHELA, claiming that the company misled its borrowers. Read to learn more.

-

Alabama Community College Mismanaged Nearly $450K in Funds, Audit Finds

-

Student Loan Update: Federal Appeals Court Blocks Biden's Student Debt Repayment Plan

-

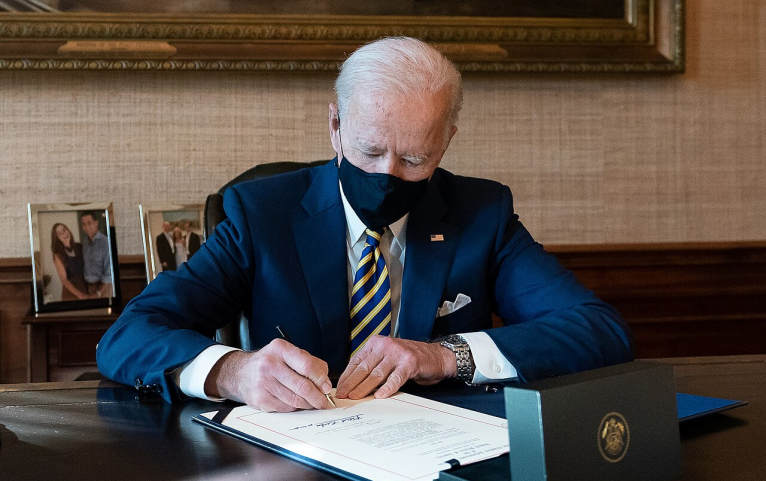

Student Loan Update: Biden Administration to Forgive $1.2 Billion in Student Loan Debt

-

Market Areas Hedge Funds Like Armistice Capital Have Reduced Their Investments

-

Student Loan Update: $18M in Tax Credits Now Open to Borrowers in This State

-

10 Pennsylvania Universities Vote to Keep Tuition Under $8K For 6th Straight Year

-

US Higher Education Trends: State Funding Rises as Tuition Income Falls; What Can UK Learn From This?

By Joy Liwanag -

Congress Moves to Mandate October 1 FAFSA Release Date, Addressing Delays and Ensuring Timely Financial Aid Access

By Joy Liwanag -

Congress Introduces Campus Housing Affordability Act, Expanding Section 8 Voucher Access for College Students

By Joy Liwanag -

Northwestern College Shuts Down After 122 Years, Leaving Students and Higher Education Community in Limbo

By Joy Liwanag -

Americans' Confidence in Higher Education Continues to Decline Amid Rising Concerns Over Political Bias and Cost [Poll]

By Joy Liwanag -

African Students Rack Up Debt Despite Full Bursaries from NSFAS

By Joy Liwanag -

International Students and Financial Hurdles in Higher Education: Here Are Practical Tips That Could Help

By Joy Liwanag -

FAFSA Rollout Challenges Students and Institutions Amid Deadline Pressures

By Joy Liwanag -

$1.6 Trillion Student Loan Still Unpaid, Millions of Borrowers Struggle as Payments Resume

By Kareen Liez -

FAFSA Delays Cause Small Colleges to Cut Budgets and Programs

By Joy Liwanag -

MOHELA Empowers Missouri Students with Mission-Mini Grants to Boost FAFSA Completion

By Joy Liwanag -

Federal Judges Block Key Components of Biden's Student Debt Relief Plan; Borrowers May Not Get Debt Cancellation or Lower Payments

By Joy Liwanag