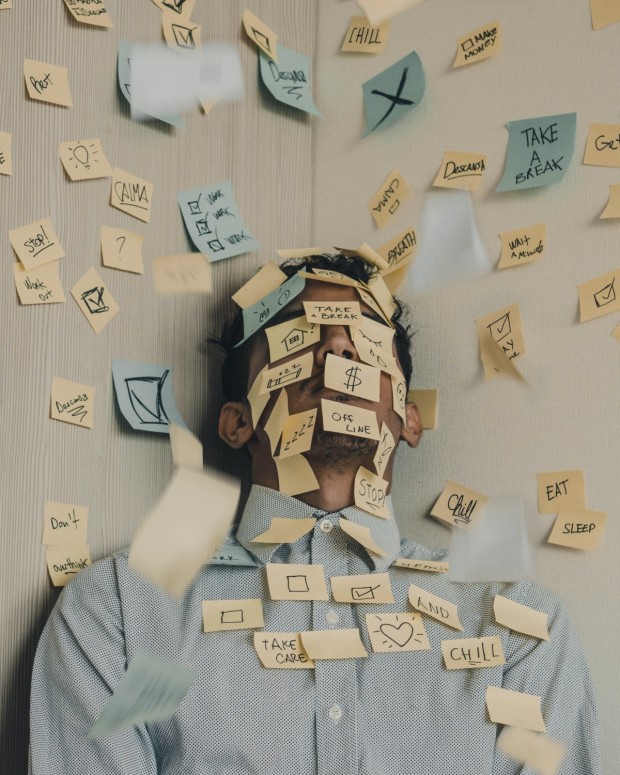

Photo : Luis Villasmil on Unsplash

Managing your accounts can be a difficult task. It can impact your physical and mental well-being. It can trigger mood swings, raise anxieties, eventually depression and suicidal ideas. It would be best to find ways to alleviate your financial stress and move toward a financially stable lifestyle. Once you do, you will be on your way to a more stress-free and happier you.

Financial Stress: An Overview

Financial stress is a type of emotional strain directly linked to money. Financial stress can affect anyone, but those with low incomes are more likely to feel it. 2 Not having enough money to cover your necessities, such as paying rent, bills, and groceries can cause stress.

People with lower incomes may be under more stress due to their jobs. When you think of taking breaks, their work might not be flexible. They may work in hazardous conditions, yet they are frightened to leave since they will not sustain themselves financially while looking for jobs.

Most people experience financial difficulty from time to time. On the other hand, financial stress might become an issue if it interferes with your daily routine. For instance, you might be incapable of focusing on or be able to enjoy different aspects of life due to the financial stress.

If you are under a lot of financial stress, it will harm your mental health and possibly even your physical health. Financial strain can cause worry, sadness, behavioral changes such as withdrawal from social activities, and physical symptoms such as stomachaches and headaches. If you are experiencing any ill effects due to your financial stress, speak with a medical expert.

How To Treat Your Financial Stress

-

KNOW THE CAUSE

The first step in managing financial stress is recognizing the causes and working towards solutions. All viable options are a tight budget, reduced credit card debt interest rates, curbing online spending, government benefits, and declaring bankruptcy. If these measures are ineffective, you can try finding another job or source of income. You can also try increasing your income. Keeping your expenses low is an excellent way to alleviate stress

-

TRACK YOUR MONEY

The second step in coping with financial stress is to learn to track your income and expenses. For example, you may find that your eating budget isn't enough, or you're having trouble paying the rent. You may need to consider changing jobs or attending a specialized group to reduce your stress.

Another step in coping with financial stress is to begin tracking your money. Even though it may be the last thing you want to do, tracking your money can help you identify problems with your spending habits and increase your income. When you write down your essential monthly expenses, such as food and shelter, you can look for ways to save by knowing where your money is getting spent.

One example of an expense that can be controlled is food. If you have a bare-minimum budget, look for ways to save money. By keeping an eye on costs, you will feel less stress. It is vital to control your finances to avoid unnecessary strain. As a result, you will feel extra relaxed and confident when managing your finances. The goal of any budget is to increase your income and ease financial tension.

-

IDENTIFY THE SOURCE

The first step in managing financial stress is identifying the sources of the problem. Identify the origins of the problem and try to solve them. If a particular expense is uncontrollable, you can cut it out or make it less stressful. By increasing your income, you'll be able to pay your bills without as much worry. In addition to reducing your spending, you can also start saving for your future. Also, doing a good deed with your money makes you stress-free. You can find places to donate a mattress or anything you like and feel better.

-

REDUCE EXPENDITURE

The first step in managing financial stress is to find a way to reduce your spending and income. Focusing on healthy eating and regular exercise are important ways to reduce stress and improve overall health. Some people also choose to practice yoga or meditate to relax. Ultimately, the solution to financial stress is to create a budget that works for you. The goal is to avoid spending more money than you earn. But if this is not possible, you can consider renegotiating the terms of your contracts.

-

MAKE TIME FOR YOURSELF

Financial stress can be overwhelming. However, it doesn't have to be. There are many supports available to aid you in coping with financial stress. It is essential to make time for yourself and connect with others as a first step. You may find that your family and friends are willing to listen and offer support. In addition to this, connecting with others will help you deal with financial stress. You'll feel more relaxed, which will help you reduce your stress. It would be best if you sleep enough. Your sleep depends on the firmness of a mattress, and you can sleep peacefully on a soft mattress.

-

CONTACT INSTITUTIONS

As long as you're not putting yourself in a position where you can't afford to pay your bills, you can seek professional help. The first step is to contact financial institutions to set up a payment plan. If you can't make payments, you can also seek support from your family and friends. You can also find a support joint or join a local support organization. By connecting with other people, you can cope with financial stress.

Summary

Although any type of stress can be harmful to your health, financial stress is hazardous. The following are some of the consequences of financial stress:

Health care is delayed because people in financial distress tend to cut corners in areas they shouldn't, such as health care. Though delaying medical care may appear to be a cost-cutting strategy, it can result in worse health outcomes and higher costs, both of which can lead to increased stress.

* This is a contributed article and this content does not necessarily represent the views of universityherald.com