Photo : 4 Things to Know About Filing Taxes While in College

Filing taxes isn't a general school subject, but it should be. You started a part-time job while trying to study, and now you need to file your taxes. You don't want to get into trouble with the IRS, but also don't know what to do with this paper labelled W-2 with a bunch of numbers on it.

In the United States, if you make less than $12,200, you don't have to file. However, if money is being taken out of your paycheck each month for federal taxes, you could get a tax refund check.

We understand that this can be confusing, so continue reading below and visit this page for a little more guidance. We've put together some key things you need to know when filing taxes in college.

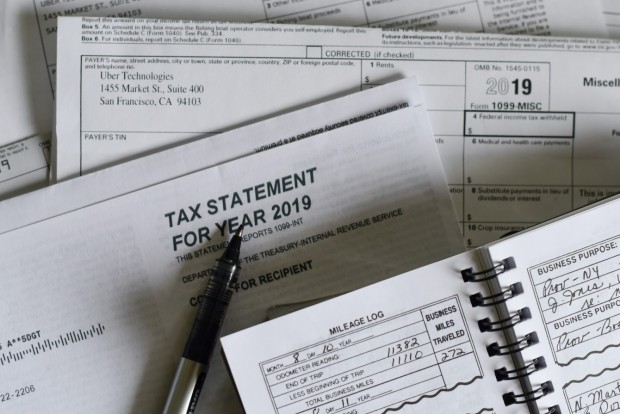

Gather Documents

Filing your taxes is much easier when you're organized. You'll want to collect your W-2 form from this year, your social security number, and a piece of scrap paper. If this isn't your first time filing, you'll also need last year's tax information.

The W-2 form will have all the numbers you have to file. You'll need to put in your social security number so the government can track your identification. A scrap piece of paper is good to have on hand when you need to write something down quickly.

Your tax information from last year might be your W-2 from the previous tax season, a print out of your tax report, or if you filed online, you could have an electronic copy. Some tax filing sites will save your information from last year too.

Know if You're a Dependent

Before you start the process, you need to call your parents to know if they're claiming you as a dependent. When your parents do this, it will limit you from receiving benefits because you can't double-dip.

For your parents to claim you, you need to be within a certain age and be financially dependent on them. Even if you're over 18 years old, your parents can claim you.

While this might be upsetting to find out because you want your tax returns, it's often better for the whole family. When you file your taxes, this is going to be one of the questions, and if you don't answer correctly, you and your family could face legal trouble.

File for Free

If you're a full-time student, likely, you're only working a few hours a week. Your total income won't be significant, so you won't need to pay for the help of an accountant. There are many ways to file for free.

There are sites that will guide you through the process and answer any questions you might have along the way. It makes it super easy to file, and also it's free, so why not. It's common knowledge that college students are always looking for a good deal.

Student Loan Form

Student loans and financial aid are based on income. It's most likely based on your parent's income, but in some cases, it's based on your own. Two forms are essential for filing taxes; the 1098-T and 1098-E.

The 1098-T form is all the expenses you paid to your college in that year. The 1098-E is the interest your student loans payments. These forms can be used for deductibles.

The Bottom Line

Filing taxes can be a little tricky when you don't know what you're doing. First, get yourself organized with all of the correct documents, ask your parents if you're a dependent, file for free, and submit student loan forms.

* This is a contributed article and this content does not necessarily represent the views of universityherald.com