The lure of the yellow metal is universal and has always created interest amongst investors in every corner of the world. As a globally accepted repository of value, gold has historically been the metal of choice for coinage. The most important concept is the spot price of gold and in this article, we will explore how this pricing works.

Finding out the spot price on a daily basis

Most reputed gold dealers will have the spot price of gold displayed on their website. Since the price of gold is a dynamically moving number, it is usually updated on their ticker every minute. The price of gold can also be viewed by visiting the sites of other organisations like the London Bullion Market (LBMA). There are several gold apps in the market, which can also tell you the price of gold.

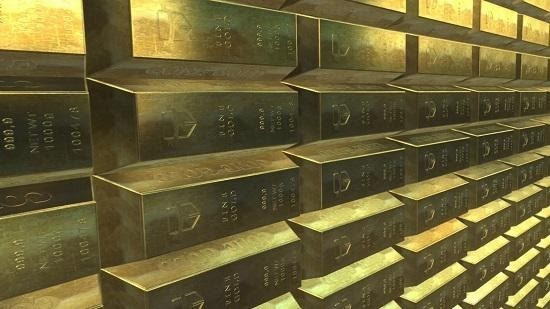

Large gold bars like these purchased by the central banks are known as good delivery bars

The spot price of gold

The spot price is only a benchmark price that regulates the market. It isn't the price at which you can buy or sell when carrying out a transaction. The price is fluid and moves constantly when markets are trading. International gold markets are closed for only a few hours each day between the closing time of the New York market and the opening of Asian markets. Of course, the markets are also closed on weekends and a few important international holidays.

Calculating premiums

As stated above, the spot price acts as a benchmark from which you can start calculating premiums. If you're wondering why premiums need to be applied, the answer is simple. The gold that you and I buy in the market is taken through a design and manufacturing process. There are costs attached to this. Additionally, the price of logistics and delivery are also added. The premium you pay when buying compensates for these expenses.

Similarly, when you sell your gold back into the secondary market, you may lose a small amount of premium. Premiums are applicable on all categories of purchases, like ETFs, gold bars, coins, and so on. Having said that, ETFs, which can be purchased electronically are priced closer to the actual spot price of gold, since there are no production and delivery costs. However, as with everything else, bulk buying will allow you to negotiate lower premiums with your preferred dealer. Of course, if you buy historical coins that attract numismatic interest, you'll pay higher margins depending on its rarity value.

The actions of international central banks can influence the price of gold. Above is the visitor centre of the Central Bank of Armenia

Factors that impact the gold price

Gold is a fairly complex commodity and the daily price reflects numerous macroeconomic factors that impact this price. We exist in an ever-changing economy and due to this, it's important to understand what these factors are.

- Global inflation is a key factor that has an impact on the price of gold. For example, if inflation rises in the US, it is an indicator of more fiat money being printed. This will always have an impact on the price

- Gold is part of a wider commodity market and its price is also dependent on the production costs and market prices of other commodities like silver, base metals, platinum, etc.

- Large trades carried out by international central banks have an important impact on the international price. For example, if Russia starts hoarding gold, the price is bound to escalate

- Production and mining costs are yet another factor since gold has to be dug out of the Earth's crust. If the price of gold in the international market falls too low, it would be unviable to continue with large-scale production and mining operations. So, the supply will start to fall

- Rising and falling interest rates also have an impact on the supply-demand curve of the yellow metal

- The health of the global economy, including adverse conditions in the global capital markets, will always impact the price of gold as wary investors may turn to gold as a 'safe haven'

- The LBMA conducts two significant meetings per day at 10:30 AM and 3 PM UK time. These meetings are conducted to provide price fixes as a reference point for the gold market. However, due to accusations of price-fixing, these prices are published only the following day

The Troy ounce

The international spot price of gold is always denoted as a price per Troy ounce. One Troy ounce is equivalent to 31.103 grams.

Pricing of gold in US dollars

The gold price is always quoted in USD per Troy ounce and then converted into grams. The price is further interpreted in other major international currencies in the respective markets of those countries. To derive the dollar price per gram, you can simply divide the spot price by 31.103, and you'll have calculated the price of gold, in US dollars per gram.

Converting the price into GBP

If you intend to convert the price to the pound sterling, you would first need to divide the price in USD per ounce by 31.103. This calculation converts Troy ounces into grams, as discussed above. At this point in time, you can apply the current exchange rate between USD and GBP, which is also a constantly changing price. Most precious metal dealers in the UK would already have made this calculation for you and their websites will display the price in GBP per gram.

Converting the price into other currencies

The gold price can be converted into different international currencies by following the same process. The first step is the conversion from Troy ounces to grams or kilos. The prevailing currency exchange rate would then become applicable, giving us the price in Japanese Yen, Chinese Yuan, Indian Rupee, Singapore Dollars, etc. It's important to note that internal market conditions, including domestic supply and demand, will have a significant impact on the premiums and price in these markets.

International countries store gold bars as protection against an economic downturn

So, as a gold investor, it's important to understand these fundamental concepts about the spot price of gold and how it works. We hope that this article has been able to shed a fair amount of light on the subject. Of course, gold will continue to play its role in the global economy as a precious metal that offers stability and protection to investors. Knowing more about how these prices work will enable you to make rational decisions when investing your money.

* This is a contributed article and this content does not necessarily represent the views of universityherald.com