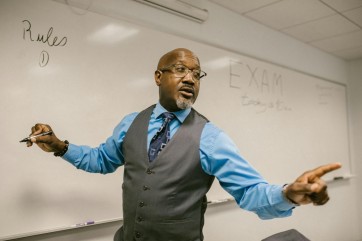

Photo : What To Know About Capital Gains in 2021

Strategic income tax planning is an important way to save money and avoid paying more than what you're legally obligated to the government.

One component of your income taxes is capital gains.

Below, we delve into everything you should know about capital gains in general and also any changes that might be taking place this year and going forward.

An Overview of Capital Gains

Capital gains are the profit you might get if you sell an asset. An asset can be a business, land, or stock shares. In most cases, the sale of an asset is taxable income.

The taxation rates of these gains depend largely on how long you had an asset before you sold it.

Short-term capital gains taxes are on the profit that you got from selling an asset you had a year or less. Short-term capital gains tax rates are the same as your tax bracket, which is your income tax rate.

Long-term capital gains tax refers to the profit you get from an asset you held over a year. The long-term capital gains rate is either 0%, 15%, or 20%. The rate you pay depends on your income and filing status.

Calculating Capital Gains

Capital gains taxes might be applied to tangible items like cars and boats, as well as real estate, stocks, and bonds.

If you sell something that applies and you make money, then that profit is your capital gain. If you sell an asset and lose money, it's known as a capital loss.

A lot of people will use losses to offset their gains.

For example, if you had a stock and sold it for a profit of $20,000 this year, and then you took a loss of $5,000 on another, you'd be taxed on gains of $15,000.

If losses are more than your gains, you can deduct the difference when you complete your tax return.

Certain things that are called collectible assets are taxed at 28% in many cases. These assets include precious metals, art, antiques and coins.

In 2020, if you're an individual filer, you didn't pay capital gains taxes if your total taxable income is at $40,000 or less. However, if your income ranges from $40,001 to $441,450, you would pay a 15% rate. If your income is above that, your rate is then 20%.

For 2021, individuals won't pay capital gains taxes if they have a taxable income that's $40,400 or below. The rate is then 15% for incomes between $40,401 and $445,850, and anything above that income and your rate goes to 20%.

How Can You Minimize Your Capital Gains Taxes?

There are quite a few strategies you can utilize to lower what you pay in capital gains taxes, including the following:

-

Use accounts that have tax advantages, like 401(k) plans, IRAs or 529 college savings accounts. When you use these tax-advantaged accounts, your investments are growing tax-free or maybe tax-deferred. You don't have to pay a capital gains tax if you're selling assets in those accounts.

-

With certain tax-advantaged accounts, which include Roth IRAs as well as the college 529 accounts, you don't pay taxes on your earnings. With a traditional IRA or a 401(k), you don't pay until you take distributions.

-

Keep your assets as long as you can. If you can keep an asset for over a year, it's going to help you get the lower long-term capital gains tax rate.

-

You could possibly exclude up to $250,000 in gains if you sell your home and you're single or up to $500,000 if you're married and file jointly. However, to qualify, you need to have owned your home and it has to have been your main residence for at least two years in the five-year period before you sold it.

-

You can rebalance using dividends if you invest. What this means is that rather than reinvesting your dividends when you get them, you can put the money from dividends into investments that aren't performing as well. Then, you don't have to sell your strongest performing investments, so you might be able to avoid paying taxes on those.

Finally, it's important that you maintain records of your losses because these offset what you owe in capital gains.

You can not only get rid of stocks that aren't performing well, but you can also save money on your taxes.

Just be cautious about the potential for engaging in a wash sale. What this means is that after you sell an investment, you have to wait at least 30 days before you buy another because otherwise, it's a wash sale. There's no tax benefit if it's a wash sale.

* This is a contributed article and this content does not necessarily represent the views of universityherald.com