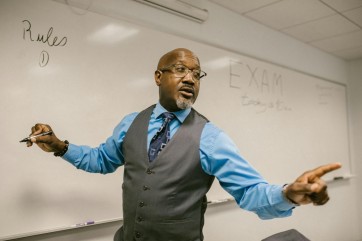

Photo : 4 Personal Finance Tips You Need to Know

Becoming an adult brings all sorts of responsibilities, with one of the most important being keeping in control of your personal finances. You need to learn all about budgeting, paying your taxes and what it takes to build a good credit score. Sound like a minefield? Don't worry, most people would agree. The following are four tips for managing your personal finances that you definitely didn't learn in economics class.

Utilize a Life Settlement

If you have a life insurance policy there are sometimes clauses therein that allow you to payout and receive a lump sum - it's not available in every policy but it exists in more than you would think. The pros and cons of the situation is the classic bird in the hand scenario but, if you are interested, you can see if you are eligible to sell your life insurance policy and see what it's worth, because it might be that the little boost you need was sitting tucked away in an unused insurance policy all this time.

Set a Budget

Yes, this comes up in every list of this type but as sure as a broken clock is right twice a day, budgets are important when keeping afloat with your money. This means being aware of everything that is coming in from your regular job and side hustles, and everything that is going out. From TV subscription services and energy bills to movie tickets and impulse buys, you need to account for all major and minor expenses. If you need help, there are apps and services all over the Internet and, if you'd rather go the low-cost route, pen and paper is equally as effective.

Tackle Credit Card Debt

If you were caught by that boom about fifteen years ago where it was fashionable for banks and lenders to give you a credit card as opposed to a temporary overdraft then chances are you are probably still paying one or more of them off. Paying that debt off should be a priority, not only because it will be less likely to be held over your head for a long period of time, but also so that you have the extra cash to yourself each month. Even a minimum payment of $5 a month can make the difference to your food shop, your entertainment budget or even just give you an extra amount to put somewhere else, potentially into savings.

Save as Much as You Can

You always get caught off guard by a large unexpected expenditure, such as an air conditioner breaking down, an act of God, or even just a little fender bender, and as a result, you are completely out of pocket. Make sure to mitigate against this by putting aside a little money each month, because you can work it out fairly easily that spreading the cost of a large expenditure over the course of several months is going to be a lot easier if you've got the bulk of it already in the bank waiting to be spent. Even if that bank is just a piggy option that you keep on your nightstand.

* This is a contributed article and this content does not necessarily represent the views of universityherald.com