College brings a lot of novel experiences for students. Before sending them on their new journey, parents need to prepare their teens on what they can expect. Money management is one important lesson that they will need to learn before going away from home.

According to U.S. News, parents should make time to start an open discussion with their kids about their personal finance. This is important because students need to be made aware that financial mistakes that they make in college could have dire repercussions that may follow them until adulthood.

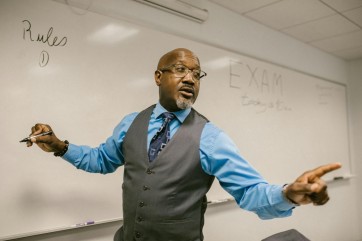

"There's a sit-down conversation that needs to happen," founder and CEO of College Advising Corps Nicole Hurd said. College Advising Corps is a nonprofit program that guides low-income, first-generation and underrepresented students to and through college.

Brad Barnett, senior associate director of the office of financial aid and scholarships at James Madison University, advised that parents should have already worked up to this discussion slowly. It means that parents should be open to their kids about budgeting, saving and spending even while they're young.

The publication shared four money management tips for college students that parents can discuss with their kids. These tips should help facilitate a conversation about finance.

1. "You need to track paperwork."

College students should already know how to organize their documents, track deadlines and check their mail regularly. This way, they can stay on top of everything that involves their studies.

2. "You don't need to keep up with the campus Joneses."

There will be a variety of people from different backgrounds, culturally and economically. Students should be objectively aware of their own status and not fall into the trap of peer pressure by keeping up with big spenders.

3. "Student loan refund checks are not free money."

Those who borrow for college and get disbursements for expenses like books, among other things, need to know that it's not free money. They are expected to budget it and spend it on things that matter. Parents also need to explain how credit cards work.

4. "It's OK to make mistakes."

No one perfects money management immediately. Allow college students to make mistakes but be there for them to guide and steer them again in the right direction.

Check out Forbes' list of the 5 best apps that can help college students save money.